Service with one employer will count as service with a second employer in different circumstances depending on the relationship between the two employers.

In this regard, it is important to determine if the employers are associated entities or not.

On this page:

Service with one employer will count as service with a second employer in different circumstances depending on the relationship between the two employers.

In this regard, it is important to determine if the employers are associated entities or not.

Service with one employer (first or old employer) will count as service with another employer (second or new employer) if two conditions are met:

An associated entity is defined in s.50AAA of the Corporations Act 2001.[2]

An entity (the associate) may be an associated entity of another entity (the principal) in the following circumstances:

The word control is defined in s.50AA of the Corporations Act. One entity controls another when the first entity can make decisions that determine the financial and operating policies of the second entity.

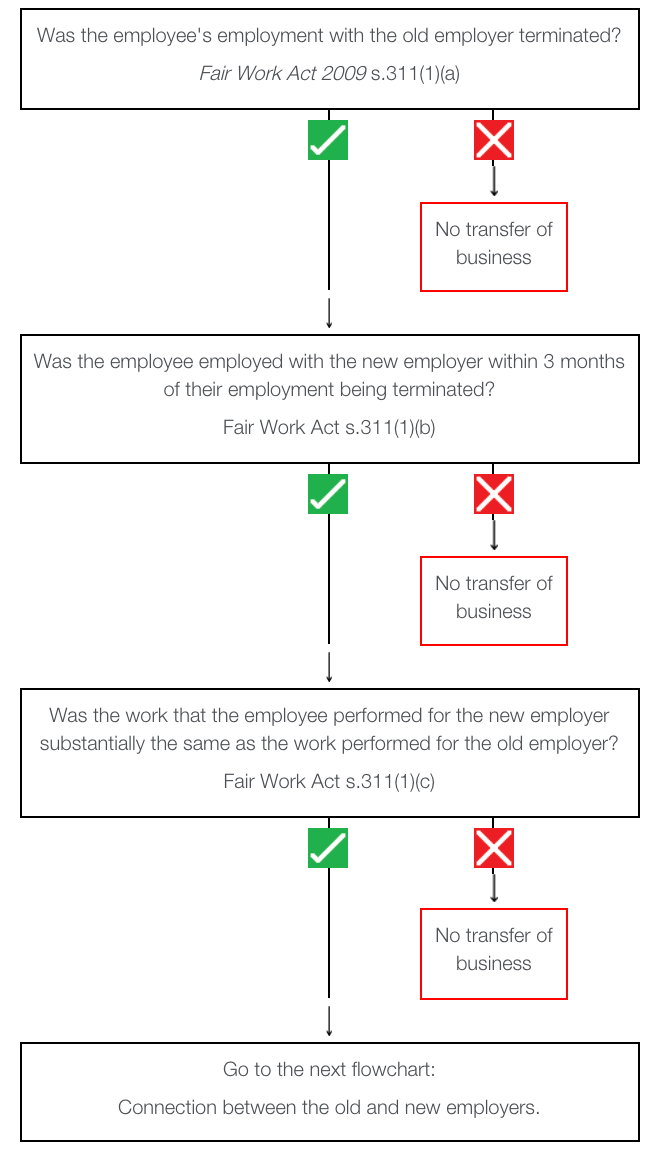

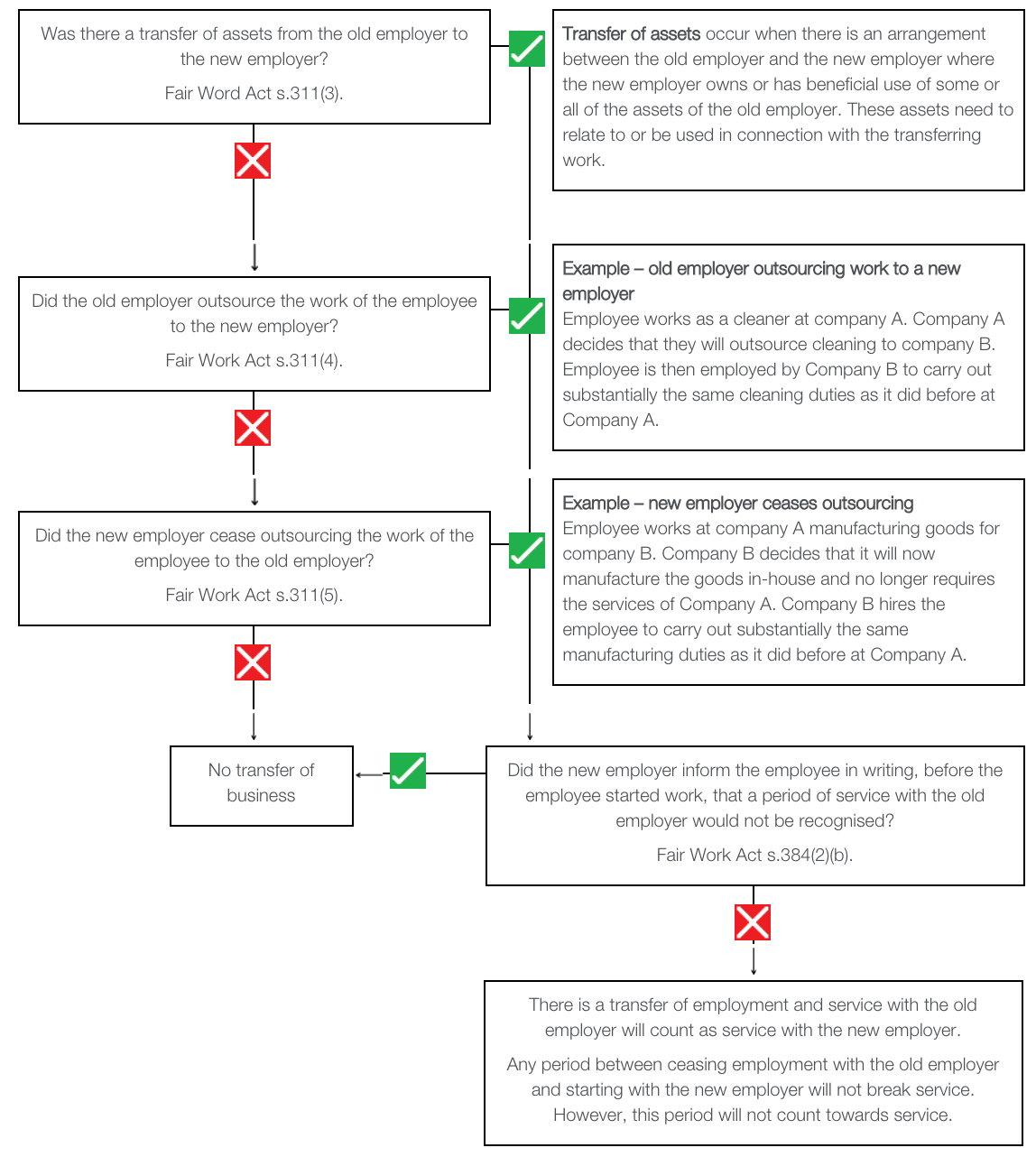

Service with one employer (first or old employer) will count as service with another employer (second or new employer) that is NOT an associated entity of the first employer, if the employee is a transferring employee in relation to a transfer of business from the first employer to the second employer.[4] The following flow chart will assist in determining whether the employee is a transferring employee.

Hill v Sahir T/A Cafe Moderno at Fountain Gate [2013] FWC 668 (Roe C, 30 January 2013).

The employee worked for the old employer in a cafe. The business was purchased by the new employer. The employee worked 3 shifts for the new employer doing the same work before he was dismissed.

It was held that there was a transfer of employment, because there was a transfer of business between the old employer and the new employer. There was a connection between the old employer and the new employer as the transfer of business involved a transfer of assets. Further, as the new employer had not informed the employee in writing that his previous service would not be recognised, the employee’s service with the old employer counted as service with the new employer.

Thorne v Jura Australia Espresso Pty Ltd [2012] FWA 4954 (Cargill C, 14 June 2012).

The employee worked for the old employer, which provided labour to the new employer. After two years, the new employer ceased to outsource work to the old employer. The old employer terminated the employee’s employment, and she was employed by the new employer, but dismissed after about 3 weeks.

The employee was found to be a transferring employee in relation to a transfer of business. There was a connection between the old employer and the new employer because the new employer had ceased outsourcing work to the old employer. The employee was not informed in writing by new employer that previous service with the old employer would not count as service with the new employer, and therefore it did count.

Szybkowski v Monjon Australia Pty Ltd [2010] FWA 7321 (Roe C, 17 September 2010).

The employee worked as a security guard for the old employer, which provided site security under contract. A tender process resulted in the new employer being awarded the contract. The employee was offered employment with the new employer but was dismissed the following month. It was held that there no connection between the employers, and therefore no transfer of business. As such, service with the old employer did not count as service with the new employer.

John Lucas Hotel Management v Hillie [2013] FWCFB 1198 (Drake SDP, Hamberger SDP, Bull C, 22 February 2013), [(2013) 224 IR 260].

Decision at first instance [2012] FWA 6806 (Cambridge C, 10 August 2012).

The employee had been employed by the old employer to work at a pub. The old employer operated the pub under a lease with the owners. The old employer abandoned the lease, and the owners leased it to the new employer. The new employer employed the employee to perform the same duties, later dismissed her. On appeal, it was found that there was no connection between the old employer and the new employer, because there was no evidence of a transfer of assets in accordance with any arrangement between the employers.

Watson v Oliver-Ramsay Group Pty Ltd [2015] FWC 221 (Watson VP, 12 January 2015).

The employee had been working as a security guard for a contractor (the previous contractor) at Federation University in Ballarat for nearly eight years. A new contractor was successful in tendering for the provision of security services and offered a job to the employee. After working for almost three months, the new contractor advised the employee that they had decided not to continue his employment beyond the probationary period.

The employee lodged an application for unfair dismissal. The new contractor objected on the basis that the employee’s continuous service at the time of the dismissal was less than the minimum period prescribed by the Fair Work Act.

The Commission found that the previous contractor and the new contractor were not associated entities. There was also no transfer of business as there was no connection between the two employers. As a result, the employee’s service with the previous contractor could not be considered. As his period of service with the new contractor was approximately three months, the employee was not protected from unfair dismissal. The application was dismissed.

Salagras v Fingal Glen Pty Ltd atf the Adelaide Riviera Trust T/A Comfort Hotel Adelaide Riviera [2011] FWA 1401 (Steel C, 3 March 2011).

The employer was one of 3 different businesses owned by separate unit trusts with separate trustee companies. Each trustee company had the same single director and each trust had the same financial manager, who were both employees of a single accountancy firm. It was held that they were associated entities. Employees of the associated entities therefore counted for the purpose of determining whether the employer was a small business.

Adams v Condamine Catchment Natural Resource Management Corporation Limited T/A Condamine Alliance [2010] FWA 5374 (Richards SDP, 22 July 2010), [(2010) 205 IR 230].

An employer was held not to be associated with other entities to which it provided funds under contract for the performance of project work, because this relationship was not such as to give the employer control over the other entities. Accordingly, the employees of the other entities did not count for the purpose of determining whether the employer was a small business.

[1] Fair Work Act s.22(7)(a).

[2] Fair Work Act s.12.

[3] Corporations Act s.50AAA(2)‒(7).

[4] Fair Work Act s.22(7)(b).