Joelle Leggett, Shannon-Kate Archer and Elizabeth Leung

Minimum Wages and Research Branch—Fair Work Australia

February 2010

The contents of this paper are the responsibility of the authors and the research has been conducted without the involvement of members of the Minimum Wage Panel of Fair Work Australia.

ISBN 978-0-9807678-4-1

© Commonwealth of Australia 2010

This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission from the Commonwealth.

Requests and inquiries concerning reproduction and rights should be addressed to the Commonwealth Copyright Administration, Attorney General’s Department, Robert Garran Offices, National Circuit, Barton ACT 2600 or posted at http://www.ag.gov.au/cca.

All research undertaken by or commissioned by Fair Work Australia for the Annual Wage Review 2009-10 has been agreed by the Research Group. The Research Group comprises a Chair from the Minimum Wage and Research Branch of Fair Work Australia, and representatives nominated by:

This paper, “Employees with disability: open employment and the Supported Wage System (SWS)”, is the work of Joelle Leggett, Shannon-Kate Archer and Elizabeth Leung of the Minimum Wages and Research Branch, Fair Work Australia.

A draft of this paper was workshopped with the Research Group prior to finalisation. Joelle Leggett, Shannon-Kate Archer and Elizabeth Leung would also like to thank the Research Group for its comments.

The contents of this research paper, however, remain the responsibility of the authors, Joelle Leggett, Shannon-Kate Archer and Elizabeth Leung.

Contents

1. Employees in open employment whose disability impacts on their productive capacity 9

1.1 Historical development of the SWS 9

1.1.1 Disability wages prior to SWS 9

1.1.2 The National Employment Initiatives for people with disabilities report 10

1.1.4 Employment of People with Disabilities Senate Inquiry Report 12

1.2 Implementation of the SWS 13

1.2.1 Workplace Relations Act 1996 16

1.2.2 Workplace Relations (Work Choices) Amendment Act 2005 16

1.2.3 Workplace Relations Amendment (Transition to Forward with Fairness) Act 2008 18

1.2.4 Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 18

2 Employees in open employment whose disability does not impact on their productive capacity 23

3 The Fair Work Act 2009 and annual wage reviews 30

Appendix A: Modern Award SWS Model Clause (2010) 33

Appendix B: SWS Model Clause (1994) 36

Appendix C: AFPC Special Federal Minimum Wage No.1 39

Appendix D: AFPC Special Federal Minimum Wage No.2 39

Appendix E: AFPC SWS Pay Scale 1. 42

Appendix F: Coverage of FW Act minimum wage instruments from 1 January 2010 46

List of Figures

Figure 1: Number of SWS Assessments, 2005–2009 22

List of Acronyms and Abbreviations

Abbreviation |

Explanation |

ABS |

Australian Bureau of Statistics |

ACCI |

Australian Chamber of Commerce and Industry |

ACROD Ltd |

Australian Council for Rehabilitation of the Disabled Ltd (now National Disability Services) |

ACTU |

Australian Council of Trade Unions |

ADE |

Australian Disability Enterprises (formerly known as Business Services) |

AFPC |

Australian Fair Pay Commission |

AHRC |

Australian Human Rights Commission |

AIRC |

Australian Industrial Relations Commission |

DD Act |

Disability Discrimination Act 1992 (Cth) |

DEEWR |

Australian Department of Education, Employment and Workplace Relations |

DSP |

Disability Support Pension |

DS Act |

Disability Services Act 1986 (Cth) |

FaHCSIA |

Australian Department of Families, Housing, Community Services and Indigenous Affairs |

FWA |

Fair Work Australia |

FW Act |

Fair Work Act 2009 (Cth) |

FW (Transitional Provisions) Act |

Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 (Cth) |

FMW |

Federal Minimum Wage |

HREOC |

Human Rights and Equal Opportunity Commission (now the AHRC) |

Pay Scale |

Australian Pay and Classification Scale |

PSPSRTCA & BU |

Public Sector, Professional, Scientific Research, Technical, Communications, Aviation and Broadcasting Union (now the Community and Public Sector Union) |

Special FMW No.1 |

AFPC Special Federal Minimum Wage No.1 – Employees with a disability who are able to earn full adult, junior or trainee wages as the effects of their disability do not impact on their productive capacity |

Special FMW No.2 |

AFPC Special Federal Minimum Wage No.2 – Employees with a disability who are unable to perform the range of duties to the competence level required because of the effects of a disability on their productive capacity and are not currently covered by a Pay Scale |

Special Pay Scale 1 |

Special Supported Wage System (Employees with a Disability) Australian Pay and Classification Scale (Supported Wage System Pay Scale), [2007] APCS 1 |

Special Pay Scale 2 |

Special Business Services (Employees with a Disability) Australian Pay and Classification Scale, (Special Business Services Pay Scale), [2007] APCS 2 |

SS Act |

Social Security Act 1991(Cth) |

SWS |

Supported Wage System |

WAT |

wage assessment tool |

WR Act |

Workplace Relations Act 1996 (Cth) |

Work Choices Amendment Act |

Workplace Relations Amendment (Work Choices) Act 2005 (Cth) |

Related papers and decisions on this issue include:

Australian Bureau of Statistics, (2002) Survey of Disability, Ageing and Carers (SDAC), ABS, Canberra

Australian Bureau of Statistics, (2003) Disability, Ageing and Carers, Australia: Summary of Findings, CAT No. 4430.0, ABS, Canberra

Australian Bureau of Statistics, (2004) The latest release was the 2003 Survey of Disability, Ageing and Carers (SDAC), CAT No. 4430.0, ABS, Canberra

Australian Fair Pay Commission, Wage-Setting Decisions

Australian Council of Trade Unions and Others (Supported Wage System for People with a Disability) (1994) AIRC PR L5723

Centrelink, Eligibility for Disability Support Pension 2010 http://www.centrelink.gov.au at 14 January 2010

Disability Information and Resource Centre Inc., History of Disability in South Australia http://history.dircsa.org.au/1900-1999/invalid-pension/ at 6 January 2010

Wages and Allowances Review 2006 [2006] AIRC, PR002006

Executive summary

Fair Work Australia (FWA) is the national workplace relations tribunal. It is an independent body with power to carry out a range of functions as established by the Fair Work Act 2009 (FW Act). As part of these legislative functions, FWA must establish and maintain a safety net of fair minimum wages for national system employees.1 The Minimum Wage Panel of FWA is responsible for conducting annual wage reviews, which must include making a national minimum wage order (for all award/agreement free employees2), as well as reviewing modern award minimum wages.3

In its 2009-10 annual wage review, the Minimum Wage Panel will be responsible for setting minimum wages for award/agreement free employees with disability4 in the national system. These employees include:

The Minimum Wage Panel will also review the wages of employees with disability through its review of modern awards, transitional Australian Pay and Classification Scales (transitional Pay Scales) or Division 2B State awards.

This paper reviews the history of wage-setting arrangements for employees with disability in open employment, with and without affected productivity. It also reviews the development of the Supported Wage System (SWS) and the FW Act annual wage review requirements in relation to employees with disability.

The SWS provides a wages system that calculates pro rata wages based on an employee’s productivity (where an employee is unable to work at a fully productive capacity).

Over time, following a number of reviews and changes in the legislative framework, access to the SWS has expanded. In open employment, the SWS currently operates as a term of an industrial instrument (e.g., model clauses in modern awards, enterprise agreements or transitional Pay Scales) or under the transitional special national minimum wage derived from the AFPC Special Federal Minimum Wage No 2.6 A SWS wage assessment determines the percentage of productivity applicable to the relevant wage rate. An employee with disability whose wages are assessed under the SWS is still otherwise subject to same terms, conditions and entitlements as their co-workers as outlined in the relevant industrial instrument.

If an employee is in open employment and their productivity is unaffected by their disability, the employee is entitled to the full minimum wage that covers their employment, e.g., the same minimum modern award rate as other employees without disability. It is not clear how many employees of this class exist in the national system.

As part of the Minimum Wage Panel’s first decision, it must set a special national minimum wage for all award/agreement free employees with disability in the national system who are currently covered by the transitional special national minimum wage for employees with a disability.7 This includes employees with and without affected productivity. The transitional special national minimum wages do not currently apply to award/agreement free employees with disability who are junior employees or employees to whom training arrangements apply.8

Section 12 of the Fair Work Act 2009 defines an employee with disability as:

... a national system employee who is qualified for a disability support pension as set out in section 94 or 95 of the Social Security Act 1991, or who would be so qualified but for paragraph 94(1)(e) or 95(1)(c) of that Act.

Under the Social Security Act 1991 (SS Act), a person qualifies for the Disability Support Pension (DSP) where the person is 16 and is permanently blind (s.95) or satisfies the criteria of section 94(1) of the SS Act, which provides that the person qualifies for the DSP qualification if:

a) the person has a physical, intellectual or psychiatric impairment; and

b) the person’s impairment is of 20 points or more under the Impairment Tables; and

c) one of the following applies:

(i) the person has a continuing inability to work;

(ii) the Health Secretary has informed the Secretary that the person is participating in the supported wage system administered by the Health Department, stating the period for which the person is to participate in the system; and

d) the person has turned 16 …

Section 94 also provides that a person will meet the requirement of a ‘continuing inability to work’ where they are unable to work independently of a program of support (or undertake training to enable such work) for at least 15 hours per week at a relevant minimum wage for a fully productive employee.

There are two types of employment where wages can be set specifically for employees with disability:

This paper reviews wage-setting for employees with disability, (as defined by the FW Act), who are in open employment, including:

The SWS is also available to Australian Disability Enterprises (ADEs) as a wage assessment tool (WAT).12 For a review of the wage arrangements for employees with disability working in ADEs see Australian Disability Enterprises: sector profile.13

1. Employees in open employment whose disability impacts on their productive capacity

The Australian Government’s policy position outlines that many people with disability may require ‘a reliable process of wage assessment … related assistance in the workplace … [and] income support …The purpose of the SWS is to provide this assistance and therefore create integrative (sic) job opportunities.’14 The SWS provides a wages system that calculates pro rata wages based on an employee’s productivity (where an employee is unable to work at a fully productive capacity).

In open employment, the SWS currently operates as a term of an industrial instrument, e.g., as a model clause in a modern award, enterprise agreement, transitional Pay Scale, Division 2B State award or agreement or under the special national minimum wage derived from the AFPC Special Federal Minimum Wage No 2 (Special FMW No 2). An SWS wage assessment determines the percentage of productivity applicable to the relevant wage rate. An employee with disability whose wages are assessed under the SWS is still otherwise subject to same terms, conditions and entitlements as their co-workers as outlined in the relevant industrial instrument.

1.1 Historical development of the SWS

1.1.1 Disability wages prior to SWS

Before the introduction of the SWS, some employees with disability who were engaged in open employment with affected productivity were employed under one of the three following wage arrangements:15

The Australian Government found that these arrangements did not ensure that employees with disability received ‘appropriate wages’ as:

Wages in ‘special wage’ or ‘slow worker’ permit systems were preserved as Pay Scales (now transitional Pay Scales) by the Workplace Relations Amendment (Work Choices) Act 2005 and continue until terminated by FWA18. ‘Slow and infirm worker provisions’ in federal awards were largely phased out with the introduction of the SWS into federal awards from 1994.

1.1.2 The National Employment Initiatives for people with disabilities report

In 1990, the Australian Government commissioned the National Employment Initiatives for people with disabilities report19 (Ronalds Report) which examined employment issues for people with a disability and recommended future directions in policy. The Ronalds Report identified barriers to employees with disability entering open employment. Barriers identified included:

One of the key findings of the Ronalds Report was that employees with disability with reduced productive capacity were vulnerable to exploitation within the workforce:

The wage income of most worker permit holders is insufficient to cover living costs … [and] for this group of permit holders, receipt of income support may make them vulnerable to unscrupulous employers who are prepared to pay minimal wages regardless of the worker’s level of skills. The absence of effective monitoring arrangements in the permit system contributes to this vulnerability …The major issue is … ensuring that people with disabilities have access to integrated employment opportunities in the general labour market ... As none of the systems which currently operate is wholly satisfactory, the way is open to design an improved and effective system.21

The report also emphasised the importance of appropriate wage payments in achieving better integrated employment opportunities for people with disability:

… a fair and equitable system of measuring skills and productivity and paying a reasonable wage needs to be developed. This development will assist people with more severe disabilities who are unable to work at competitive norms. No system currently exists which enables the effective measurement of productivity and the payment of a productivity-based wage … There is a clear need to develop a new system to ensure all workers with disabilities are paid an equitable wage which recognises their work and their contribution to society.22

The report made several recommendations concerning wage-setting for employees with disability, including that:

After the release of the Ronalds Report, the Australian Government commissioned further research into developing a pro rata wage system for employees with disability in open employment.24

A follow-up report by Chris Ronalds, titled Report of the National Consultations with people with a disability was released in 1991, providing further consideration of different wages systems.25

1.1.3 Consultancy on the development of a national assessment framework for a supportive wages system: report to the Wages Subcommittee of the Disability Task Force

In 1992, the then Australian Department of Industrial Relations (now DEEWR) commissioned the report Consultancy on the development of a national assessment framework for a supportive wages system: report to the Wages Subcommittee of the Disability Task Force26 (the Dunoon Report). The Dunoon Report recommended introducing a wage assessment system which would operate within the existing industrial relations framework. It outlined a set of guidelines to determine the percentage of the award rate to be paid to an employee with disability.

Key to the system developed by the Dunoon Report was that changes be implemented via provisions in awards, using existing wages and classifications as benchmarks:

The foundation for the operation of industrial relations and wage setting in Australia is the award system. Accordingly, the consultants have developed the assessment system to have regard to award structures and coverage. The ‘benchmarks’ against which assessment would be performed would be the wage rates and classification standards established within awards.

…

The system as developed here is designed to be capable of implementation in a straightforward manner in all instances where people with disability are working in individual jobs in open employment, where there is award coverage. The overwhelming majority of workplaces would be covered by awards. It is the expectation (indeed, the legal requirement) that the wages and conditions for employed people with disabilities would be covered by an award operating in the workplace.27

The current SWS is largely based on the recommended model developed in the Dunoon Report.

1.1.4 Employment of People with Disabilities Senate Inquiry Report

In 1988, the Disability Task Force (an interdepartmental consultative group) was established by the Australian Government. Its role was to oversee the implementation of the government’s Disability Reform Package. In 1989, the then Minister for Community Services and Health commissioned a consultancy to review the employment of employees with disability. The Ronalds Report was the result of that consultancy. Subsequently, a Wages Committee was formed to advise the Disability Task Force on a supported wages system for employees with disability. The Wages Committee engaged Mr Don Dunoon to advise on the assessment process associated with the supported wages system (which resulted in the Dunoon Report).28

At the same time, a Senate Standing Committee began an inquiry into employment options and issues for people with disabilities, which concluded in December 1990. 29 In April 1992, the then Senate Standing Committee published its findings, in particular reporting on whether current and future employment options met and would meet the needs of people with disabilities.30

The inquiry made a number of findings in the area of wage setting for employees with disability, including employees with disability in open employment. It also recognised the ongoing work undertaken on wage setting by the Wage Subcommittee of the Intergovernmental Disability Taskforce (which reviewed the findings of the Ronalds Report).

The inquiry found that wages available to employees with disability were generally linked to productivity levels and there was a ‘ … benefit of a skills based wage system … [which is] likely to be the major means by which some people with severe disabilities are able to obtain full award wages.’31 The inquiry also reported on the use of slow worker permits, and similarly to the Ronalds Report, stated the difficulties associated with their use stating that it “… could be utilised to avoid a proper consideration of the individual’s abilities …”32

The inquiry’s recommendations included that the Australian Government ‘ … implements a wage system to meet the income needs of people with disabilities unable to work full-time at … award wages’.33 The inquiry noted the Dunoon Report’s findings that a supported wages system should:

Following the Dunoon Report, the Australian Government, together with peak industrial councils and bodies representing people with disability, developed the SWS.35 After this, in 1994 the Australian Council of Trade Unions (ACTU), Australian Chamber of Commerce and Industry (ACCI), the then Public Sector, Professional, Scientific Research, Technical, Communications, Aviation and Broadcasting Union (PSPSRTCA & BU) and then Minister for Industrial Relations made a joint consent application to the AIRC for federal awards to be varied to include the SWS wages clauses.36

In its decision, the AIRC described the SWS as ‘an important social and industrial advance’.37

The AIRC, with the consent of parties, adopted a model clause for insertion into federal awards on application by the parties. This clause:

|

SWS wage assessments are usually conducted by an assessor contracted by DEEWR. However, if the relevant industrial instrument provides for it, the wage assessment may also be carried out by:

Assessors are required to have:

The Australian Government covers the cost of all SWS assessments that are arranged by DEEWR and facilitated by a DEEWR–contracted assessor.41 Under the modern award SWS Model Clause, an approved assessor must consult both the employer and employee, and (if an employee requests) the relevant union.42 Process Before an employee undertakes an initial SWS assessment, the employee may undertake a work trial which should include induction or training as appropriate. This trial period should not exceed 12 weeks, although this can be extended for an additional four weeks where necessary. During this time the employee must receive the applicable minimum wage (as at January 2010 this is $71 per week).43 SWS assessments for all SWS employees should be conducted at least annually, or as otherwise provided for in their industrial agreement or award. This is to ensure the employee’s level of productivity is accurately reflected in their remuneration. If the employee agrees with the outcome of the assessment, it is signed by the employee. The employee then receives the assessed percentage of the relevant award classification (provided the amount payable per week is not less than the minimum rate specified in the instrument). The SWS Model Clause in modern awards provides supported wage rates linking the assessed capacity of the employee with a specified percentage of the relevant minimum wage specified in the award. For example, an employee assessed at 10 per cent capacity would have a minimum wage of 10 per cent of the relevant classification wage specified in the award. The SWS Model Clause in modern awards provides that where an employee’s assessed capacity is 10 per cent, they must receive a high degree of assistance and support.44 |

(See Appendix B for full text of the 1994 SWS Model Clause).

1.2.1 Workplace Relations Act 1996

In 1996 the Workplace Relations Act 1996 (WR Act) came into effect, replacing the Industrial Relations Act 1988. To assist the inclusion of the SWS into federal awards,45 the WR Act required that the AIRC, in performing its functions of establishing and maintaining a safety net of fair minimum wages, to consider the need to provide a SWS for people with disability.46 The WR Act also required the AIRC, where appropriate when making an order or award, to provide for ‘… a Supported Wage System for people with disabilities.’47

Despite the creation of the SWS and the new WR Act provisions, the SWS was not implemented uniformly across federal and state systems. In the state systems, access to the SWS was usually through ‘enabling’ provisions in awards which were included on an ‘award by award’ basis.48 The result was that coverage was largely ‘slow and uneven’ and many awards were not varied to include access to the SWS.49 This was also the case in the federal system, whereby awards which had not been reviewed by the AIRC (taking into account the WR Act provision) were not varied to provide access to the SWS. As a result there were gaps in coverage for employees with disability seeking access to the SWS.

1.2.2 Workplace Relations (Work Choices) Amendment Act 2005

The Workplace Relations (Work Choices) Amendment Act 2005 (Work Choices Amendment Act) significantly expanded the reach of the federal industrial relations system to include employees in State systems, including those with disability through the use of the corporations power (section 51 (xx)) of the Constitution. The Work Choices Amendment Act also changed the existing wage system by removing minimum wage rates and casual loadings from awards and preserving them in new wage instruments known as Pay Scales.

Under the Work Choices Amendment Act, the Australian Fair Pay Commission (AFPC) was established to set minimum wages, adjust basic period rates of pay, piece rates of pay and casual loadings in Pay Scales. The AIRC retained the responsibility for setting minimum wages in transitional awards50 and varying the allowances which remained in awards.

The Work Choices Amendment Act required the AFPC, in performing its wage-setting function, to promote the economic prosperity of the people of Australia by (among other things) having regard to providing minimum wages for employees with disabilities that ensure those employees are competitive in the labour market.51 The AFPC was also required to have regard to the need to provide pro rata disability pay methods for employees with disabilities.52

The Work Choices Amendment Act allowed for the continued operation of the SWS by preserving existing disability wage arrangements as preserved Pay Scales.

Submissions to the AFPC’s first wage review in 2006 highlighted that there were gaps in coverage for some employees with disability:

A number of APCSs have gaps in SWS coverage because they have been derived from pre-reform federal or State awards. Many of these federal and State awards did not provide access to the SWS for employees with a disability. Employees with a disability who are covered by an APCS that does not provide access to the SWS, can only be paid the full wage guaranteed under that APCS.53

The Australian Government stated in its submission that:

Given the widespread acceptance of the SWS and its ability to set the minimum wages for employees with a disability that ensure they are competitive in the labour market, the Commission [AFPC] could consider determining a special APCS [Pay Scale] that provides universal access to the SWS under APCS by filling all gaps in its coverage.54

To address the gaps for employees in open employment whose disability impacts on their productive capacity raised in submissions, in its first minimum wage decision, the AFPC created two new wage-setting instruments:

In setting wages for employees using the SWS, the AFPC retained the historical nexus with the income test–free threshold for the Disability Support Pension (DSP), which at that time was $64 (currently $71).56 This meant that no employee using the SWS could be paid less than this minimum weekly amount, regardless of their assessed productive capacity or hours of work.

The AIRC, in conducting its Wages and Allowances Review 2006,57 also decided that, as a general rule, the model SWS clause should be included in any transitional awards that did not include SWS provisions:

The Commission has generally supported the formulation of the model SWS provisions and their inclusion in awards. We also note that in its recent decision the AFPC has extended SWS provisions to all federal wage instruments ... As a general rule supported wage system provisions should be included in all transitional awards.58

1.2.3 Workplace Relations Amendment (Transition to Forward with Fairness) Act 2008

The Workplace Relations Amendment (Transition to Forward with Fairness) Act 2008 required the AIRC to undertake the award modernisation process in accordance with a written request from the Minister for Employment and Workplace Relations to the President of the AIRC.59 Award modernisation is the process undertaken by the AIRC (and now Fair Work Australia) of reviewing and rationalising awards in the national system to create a single system of modern awards. Modern awards apply to industries or occupations generally, regardless of state or territory boundaries. Modern awards also include terms dealing with minimum wages and classifications. Clause 25 of the Minister’s request (as amended) to the AIRC addressed the matter of disability wages in modern awards, and asked that the AIRC:

… provide a comprehensive range of fair minimum wages for all employees including, where appropriate, junior employees, employees to whom training arrangements apply and employees with a disability in order to assist in the promotion of employment opportunities for those employees.60

As a result of the award modernisation process, the AIRC has included a model SWS clause into most modern awards61 (see Appendix A).

1.2.4 Fair Work (Transitional Provisions and Consequential Amendments) Act 2009

Most provisions of the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 (FW (Transitional Provisions) Act) came into effect on 1 July 2009.

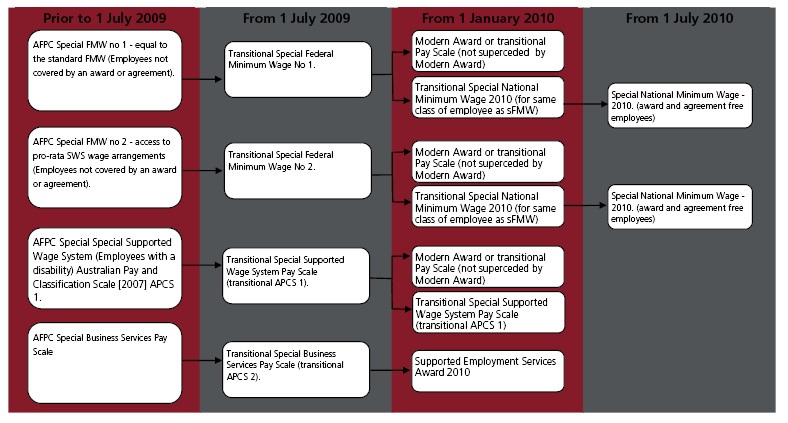

The FW (Transitional Provisions) Act also provided for the transition of industrial instruments (including those affecting employees with disability) from the WR Act system into the new FW Act system of minimum wage-setting, with modern awards and the transitional national minimum wage order which commenced operation on 1 January 2010.

The FW (Transitional Provisions) Act also provided for the transition of industrial instruments (including those affecting employees with disability) from the prior WR Act into the new system of wage-setting and modern awards to commence on 1 January 2010.

The FW (Transitional Provisions) Act provides that Pay Scales (which from 1 July 2009 became transitional pay scales),62 cease to cover an employee when a modern award that covers the employee comes into operation.63 Where an employee was not covered by a modern award, they would continue to be covered by a transitional Pay Scale unless it is terminated by FWA.64 Similarly, employees with disability who were previously covered by the AFPC’s special FMW No. 2 are covered by the transitional national minimum wage order setting a special national minimum wage65 unless covered by a modern award.66

This means that employees with disability who were covered by the AFPC’s Special Pay

Scale 1 or Special FMW No. 2 are no longer covered by these instruments if a modern award applies to that employee (see Appendix G for detail of the transition of WR Act industrial instruments).

Given that coverage of modern awards is based on industry or occupation (rather than respondency or location), access to the SWS is likely to have changed with the introduction of modern awards.

1.2.5 Fair Work Amendment (State Referrals and Other Measures) Act 2009 amendments to the FW (Transitional Provisions) Act

Under the amendments introduced by the Fair Work Amendment (State Referrals and Other Measures) Act 2009, from 1 January 2010 the national system covers state employees of private sector employers who were not previously covered by the national system (e.g., employees of sole traders and partnerships) where the states have referred powers to the Commonwealth in this respect.67 Employees who are covered by the national system as a result of the states' referrals of power are known as 'Division 2B State reference employees'.68

Employees with disability who are Division 2B State reference employees and are covered by a Division 2B State award or employment agreement, will continue to be covered by that instrument until 1 January 2011, and must be paid a minimum wage that is at least equal to the special national minimum wage. Award/agreement free employees, generally speaking, must be paid at least the national minimum wage or special national minimum wage, or where this amount would be less than the ‘State minimum amount.’69

This means that from 1 January 2010, Division 2B State reference employees with disability in open employment whose disability does impact on their productive capacity cannot earn less than the minimum rates specified and determined by transitional special national minimum wage 2 (if applicable).70 However, employees with disability whose wages were determined by a state issued permit (such as a state issued slow worker permit), are excluded from the application of the transitional special national minimum wage 2 until either the cessation of the permit or 1 January 2011 (whichever is sooner).71

In addition, the amendments to the FW (Transitional Provisions) Act mean that the Minimum Wage Panel now must, as part of its first annual wage review, review and may vary Division 2B State awards which may cover an employee with disability (as with modern awards).72

1.3 Employees who are not covered by special NMW No 2

1.3.1 Junior employees and employees to whom training arrangements apply

Many junior employees and employees to whom training arrangements apply, who are also an employee disability (as defined by the FW Act), will have their minimum wages set by modern awards or transitional Pay Scales

The transitional special national minimum wage 2 expressly excludes its application to employees with disability who are junior employees and employees to whom training arrangements apply.73 Consequently, these employees are not currently covered by the special national minimum wage. This is also the case for junior employees or employees to whom training arrangements apply without disability who are award/agreement free.74

Where the SWS system does apply to a junior employee with disability, the SWS Handbook states that persons must be at least 15 years of age to participate and be assessed under the SWS. Under the FW Act75, an employee must also meet the impairment criteria for receipt of the DSP as determined by Centrelink. To meet the impairment criteria for the DSP, a person must be 16 years or over.76

Under these parameters, junior rates of pay under the SWS system for employees with disability may only be set for employees 16 years of age and over.

1.3.2 Contractors, employees in short-term or temporary jobs, or employees engaged in work where core duties and tasks change frequently

The SWS Handbook is used by assessors to determine the productive capacity used in calculating the pro-rata wage for the SWS. The SWS Handbook is referenced in the SWS Model Clause (Appendix A), Special FMW No.2 (Appendix D) and SWS Pay Scale 1 (Appendix E) as the source which documents and defines the operation of the SWS for the purpose of these instruments.77

The SWS Handbook states:

The SWS is not intended for contractors, short-term or temporary jobs, nor for jobs which the core duties and tasks often change. 78

This may mean that this category of employee79 may not have assessments undertaken. If an assessment is not undertaken, these employees are excluded from the operation of the SWS Model Clause and SWS Pay Scale 1. If assessments are not carried out the minimum requirements that apply during the trial period also do not apply as a trial period applies only for the conduct of an assessment.80

Employees covered by transitional national minimum wage 2 in this category are covered by minimum wage requirements for a minimum weekly wage (currently $71), regardless of the hours worked.

1.4 Profile of employees using SWS

One of the key problems in creating a profile of employees using the SWS is the absence of current statistical data relating to these employees. Data concerning these employees has been recorded by federal government departments over time. Currently, the SWS is administered by DEEWR which has not released participant data, other than the number of people with disability assessed under the SWS program each year.

The following information outlines the available published data on employees with disability using SWS. It is relevant to note, that due to data limitations, it is unclear what percentage of employees using SWS are in open employment or in ADE’s.

Since its implementation in federal awards in 1994, the Australian Government has stated that SWS take-up has increased steadily.81 This take-up has been attributed to

The number of SWS assessments performed in a year is indicative of the number of SWS employees, as each employee should have their productive capacity assessed on annual basis.

Figure 1: Number of SWS Assessments, 2005–2009

Source: DEEWR, unpublished data, November 2009.

As the figure shows, the numbers of SWS assessments have fluctuated between 5609 in 2006-07 and 4464 in 2008-09. DEEWR have advised that the decline in assessments from 2007 to 2009 may not necessarily be indicative of decreased take up of the SWS, but may be due to late lodgment of assessments in the period.

1.4.2 Demographics of participants

In 2001 the Department of Families, Housing and Community Services (now the Australian Department of Families, Housing, Community Services and Indigenous Affairs) published an evaluation of the SWS conducted by KPMG Consulting.84 This report provides the most recent demographic data concerning SWS employees. The report indicated that in June 2000:

2 Employees in open employment whose disability does not impact on their productive capacity

Employees with disability who are fully productive (with reasonable adjustment as appropriate) in the class of work for which they are engaged do not require access to pro rata rates of pay. Employees with disability in open employment without affected productivity are entitled to full minimum wages.

Prior to the introduction of the Workplace Relations Amendment (Work Choices) Act 2005, in the federal system, employees with disability who worked in open employment without affected productivity were entitled to full wages as set by an award or agreement, if such an instrument applied. If an employee was not covered by an award or agreement, no statutory minimum rate of pay applied (as with other employees without disability) because there was no federal or national minimum wage.

Therefore, the history of wage-setting for this category of employee is the same as for the mainstream workforce. However, there were some developments relating to assisting employees with disability to enter the open employment workforce and disability discrimination law that are relevant to this category of employee.

2.1.1 Expanding opportunities for employees with disability in open employment

Over time, various inquiries and legislative changes have assisted in expanding the opportunities for employees with disability to enter and remain in open employment. This has assisted employees with disability to enter the open employment market and have access to the same wages and conditions of the mainstream workforce.

2.1.1.1 Disability Services Act 1986

The 1992 inquiry into the employment of people with disabilities titled ‘Employment of People With Disabilities: Report of the Senate Standing Committee on Community Affairs’92 noted that over time, there had been a gradual shift from caring for people with disabilities ‘…to increasing their access to the community and its opportunities, as far as was possible for individuals’.93 The introduction of the Disability Services Act 1986 (DS Act) signalled the change from ‘fairly limited options’ to a more integrated system which focused on independence, participation in the community and increasing employment opportunities for people with disability.94

In order to improve access to employment and increase opportunities for people with disability, the DS Act introduced the concept of ‘competitive employment training’ which offered placement services to assist persons with disabilities to obtain and retain paid employment in the workforce.95 The then Department of Health, Housing and Community Services (now FaHCSIA) described the target group for competitive employment training and placement services as those people with disabilities who are of working age and have the capacity to retain employment in the regular labour market, but who need assistance with training and placement and time-limited support to obtain and retain such employment.96

The aim of competitive employment training and placement services was therefore to assist people with disabilities into award wage work, usually on a full-time basis. In particular, the inquiry noted that competitive employment training and placement services were:

...directed towards individual jobs which have existed or are created in regular businesses and which primarily employ non-disabled people. An underlying principle of [competitive employment training and placement services] is that … placement can be as varied as the jobs that exist in the community.97

2.1.1.2 Disability Discrimination Act 1992

The continued improvement of employment opportunity and outcomes for people with disabilities was described by HREOC (now AHRC) as being a large part of the introduction of the Disability Discrimination Act 1992 (Cth) (DD Act).98

The DD Act, amongst other reforms, introduced a number of reforms to federal discrimination law for employees with disability. The objects of the Act specifically outlined the purpose of the Act with relation to employees with disability in the workforce outlining that:

3 The objects of this Act are:

(a) to eliminate, as far as possible, discrimination against persons on the ground of disability in the areas of:

(i) work…99

The DD Act makes it unlawful for employers to directly or indirectly discriminate against their employees (or prospective employees) on the basis of their disability.100 An employer may discriminate against a person if the employer does not make reasonable adjustments for that person so that, for example, they can perform their duties in the workplace.101 Section 6 of the DD Act provides that the imposition of any ‘requirement or condition’ by an employer which a person with a disability cannot or does not comply with, will amount to indirect discrimination if a substantially greater proportion of people without than with the disability can comply with it, and the requirement or condition is not reasonable. Note that a requirement or condition does not have to be a specific rule, policy, direction or action.102 Amendments to the DD Act were made in August 2009 to make clearer the requirement for reasonable adjustments to be made to accommodate persons with disability (including employees). This is discussed further below.

2.1.1.3 Workplace Relations Amendment (Work Choices) Act 2005

The Workplace Relations (Work Choices) Amendment Act 2005 (Work Choices Amendment Act) expanded the coverage of the federal workplace relations system through the use of the corporations power (section 51(xx) of the Constitution).103 The Work Choices Amendment Act also established a FMW for national system employees.

The Work Choices Amendment Act provided that the standard FMW did not apply to, among other classes of employee, employees with disability as defined by the legislation.104 However, the AFPC could establish a special FMW for these employees.105

2.1.1.4 AFPC 2006 Wage-Setting Decision

Submissions from the Australian Government and HREOC (now AHRC) argued that any special FMW set for employees with disability without affected productivity should not be less than the standard FMW.106 The Australian Government further advocated that the AFPC should address any coverage gaps that existed for employees in open employment whose disability did not impact on their productive capacity by creating a special FMW, at least equal to the standard FMW for Pay Scale free employees with disability.107

In its first minimum wage decision, the AFPC created the Special FMW No.1 - Employees with a disability who are able to earn full adult, junior or trainee wages as the effects of their disability do not impact on their productive capacity (Special FMW No.1). It did this to address the absence (as raised in submissions),of a FMW for employees in open employment whose disability does not impact on their productive capacity. It provided a rate of pay equal to the standard FMW to employees who were not covered by a Pay Scale with disability who work in open employment whose disability did not affect their productive capacity (a copy of this FMW is attached – Appendix C).

2.1.1.5 Fair Work (Transitional Provisions and Consequential Amendments) Act 2009

The FW (Transitional Provisions) Act provides that Pay Scales (which from 1 July 2009 became transitional instruments108), cease to cover an employee when a modern award that covers the employee comes into operation.109 Where an employee is not covered by a modern award, they continue to be covered by the transitional Pay Scale unless it is terminated by FWA.110 Similarly, employees with disability who are covered by the AFPC’s Special FMW No.1 are now covered by a transitional special national minimum wage111 unless covered by a modern award.112

2.1.1.6 Disability Discrimination and Other Human Rights Legislation Amendment Act 2008 amendment to the Disability Discrimination Act 1992

On 5 August 2009 the Disability Discrimination and Other Human Rights Legislation Amendment Act 2009 came into effect, amending the DD Act. The amendments, amongst other things, introduced provisions which expressly provide that a failure to make reasonable adjustments for people with disability, either directly or indirectly, may amount to discrimination.113 Prior to this, the High Court in Purvis v New South Wales114 had decided that there was no duty of ‘reasonable accommodation’ to be implied into the DD Act. As a result, the failure to provide reasonable accommodation for persons with disability, including in employment, would not necessarily amount to less favourable treatment and therefore, discrimination.

The term ‘reasonable adjustments’ is now defined in subsection 4(1) of the DD Act as:

… an adjustment to be made by a person is a reasonable adjustment unless making the adjustment would impose an unjustifiable hardship on the person.

Section 5(2), relating to direct discrimination, was amended to make ‘explicitly clear’ that “… a person is discriminating against another person if he or she fails to make, or proposes not to make, reasonable adjustments for the person with disability, where the failure to make such adjustments has, or would have, the effect that the person with disability is treated less favourably than a person without disability in circumstances that are not materially different.” 115 Section 5(2) now provides:

For the purposes of this Act, a person (the discriminator ) also discriminates against another person (the aggrieved person ) on the ground of a disability of the aggrieved person if:

(a) the discriminator does not make, or proposes not to make, reasonable adjustments for the person, and

(b) the failure to make the reasonable adjustments has, or would have, the effect that the aggrieved person is, because of the disability, treated less favourably than a person without the disability would be treated in circumstances that are not materially different.

Section 6(2), relating to indirect discrimination, also “…makes explicit that there is a duty to make reasonable adjustments to avoid indirect discrimination.”116 Section 6(2) now provides:

For the purposes of this Act, a person (the discriminator) also discriminates against another person (the aggrieved person) on the ground of a disability of the aggrieved person if:

(a) the discriminator requires, or proposes to require, the aggrieved person to comply with a requirement or condition, and

(b) because of the disability, the aggrieved person would comply, or would be able to comply, with the requirement or condition only if the discriminator made reasonable adjustments for the person, but the discriminator does not do so or proposes not to do so, and

(c) the failure to make reasonable adjustments has, or is likely to have, the effect of disadvantaging persons with the disability.

2.1.1.7 Fair Work Amendment (State Referrals and Other Measures) Act 2009 amendments to the FW (Transitional Provisions) Act

The Fair Work Amendment (State Referrals and Other Measures) Act 2009 similarly applies to this class of employee as with employees with disability in open employment with affected productivity (see chapter 2 discussion).

From 1 January 2010 until 1 January 2011, Division 2B State reference employees with disability in open employment, whose disability does not impact on their productive capacity, cannot earn less than the minimum rates specified in a Division 2B State award or agreement, State minimum amount or the special national minimum wage, whichever is applicable, and sets the highest rate.117

In addition, the amendments to the Act mean that the Minimum Wage Panel may, , as part of its first annual wage review, vary Division 2B State awards (which may cover an employee with disability whose productivity is not affected (as with modern awards).118

2.2 Employees who are not covered by special NMW No 1

2.2.1 Junior employees and employees to whom training arrangements apply

Many junior employees and employees to whom training arrangements apply, who are also an employee with disability (as defined by the FW Act), will have their minimum wages set by modern awards or transitional Pay Scales.

However, the transitional special national minimum wage No 1 expressly excludes application to employees with disability who are junior employees and employees to whom training arrangements apply.119 Therefore, these employees presently do not have access to a special national minimum wage or the national minimum wage.

This is also the case for junior employees or employees to whom training arrangements apply without disability who are award/agreement free.120

2.3 Profile of employees in open employment

It is not clear how many employees with disability (within the definition of the FW Act) who are fully productive are in the national system.

The Australian Bureau of Statistics (ABS) collects data on people with disability, mainly using the Survey of Disability, Ageing and Carers,121 which includes information collected on employees with a reported disability. In determining its definition of persons with disability (there is no separate definition of employee with disability), the ABS outlines that it uses definitions of disability and handicap ‘ …as proposed by the World Health Organisation in the International Classification of Impairments, Disabilities and Handicaps (ICIDH) 1980’.122

The ABS identifies persons with disability using a more expansive interpretation of disability than the FW Act, requiring persons to self-identify the following characteristics:

…a person has a disability if they report that they have a limitation, restriction or impairment, which has lasted, or is likely to last, for at least six months and restricts everyday activities. This includes:

It is not a requirement for the person with disability to identify whether they are eligible to receive the DSP or whether they fall within the definition of impairment as outlined in s.94 or s.95 of the SS Act.124

Therefore, ABS data is likely to include persons outside the definition of disability in the FW Act125 and may not include employees who fall within the FW Act definition, particularly where their disability does not impact on their productive capacity.

AHRC (previously HREOC) outlined that only a small number of people who the AHRC would define as being an employee with disability would qualify for the DSP (a requirement of the WR and FW Act definition).126

The DD Act, which the AHRC assists in implementing, defines ‘disability’ in relation to a person more expansively than the FW Act definition of ‘employees with disability; in particular, the DD Act does not specify eligibility for the DSP as being an indicator of disability:

’disability’ , in relation to a person, means:

(a) total or partial loss of the person’s bodily or mental functions, or

(b) total or partial loss of a part of the body, or

(c) the presence in the body of organisms causing disease or illness, or

(d) the presence in the body of organisms capable of causing disease or illness, or

(e) the malfunction, malformation or disfigurement of a part of the person’s body, or

(f) a disorder or malfunction that results in the person learning differently from a person without the disorder or malfunction, or

(g) a disorder, illness or disease that affects a person’s thought processes, perception of reality, emotions or judgment or that results in disturbed behaviour,

and includes a disability that:

(h) presently exists, or

(i) previously existed but no longer exists, or

(j) may exist in the future (including because of a genetic predisposition to that disability), or

(k) is imputed to a person.

To avoid doubt, a disability that is otherwise covered by this definition includes behaviour that is a symptom or manifestation of the disability.127

To this extent, there is no data available which could accurately outline the scope, size and nature of all employees with disability as defined by the FW Act, or those employees with disability under the definition of the FW Act whose disability does not impact on their productive capacity.

3 The Fair Work Act 2009 and annual wage reviews

The Minimum Wage Panel may commence its annual wage review from 1 January 2010 and must complete it by 30 June 2010..128

In its first annual wage review, the Minimum Wage Panel will be responsible for setting and varying minimum wages affecting employees with disability. This will include making a national minimum wage order setting a special national minimum wage for employees disability who are covered by transitional special national minimum wages and reviewing minimum wages for employees with disability covered by modern awards, transitional Pay Scales129 or Division 2B State awards.130

Specifically these employees will be:

(see Appendix F and G).

In conducting its annual wage review, the Minimum Wage Panel must take into account the minimum wages objective. Relevant to employees with disability in open employment, the Panel must take into account the need to provide a comprehensive set of fair minimum wages to employees with disability.131

Section 578(a) of the FW Act outlines that FWA must also (in exercising its powers) take into account ‘the objects of this Act’. The objects of the FW Act set out in section 3 provide that the purpose of the FW Act is to provide, amongst other things, a balanced framework that promotes social inclusion for all Australians, including by:

… providing workplace relations laws that are fair to working Australians … and take into account Australia’s international labour obligations …132

In 2008, Australia ratified the Rights of Persons with Disabilities Convention. Article 27 (1)(j) of the convention states that parties to the Convention shall ”Promote the acquisition by persons with disabilities of work experience in the open labour market.”

Section 578(c) further outlines that FWA must take into account ”the need to respect and value the diversity of the workforce by helping to prevent and eliminate discrimination on the basis of … physical or mental disability”. The payment of SWS wages determined by FWA is permitted by the DD Act, and is not deemed discriminatory for the purposes of this Act.133

In each wage review, the Minimum Wage Panel must:

The FW Act definition of employees with disability means that the Minimum Wage Panel’s setting of a special national minimum wage would apply to award/agreement free employees with disability as defined by the legislation.

1. Articles/Books/Reports

Department of Education, Employment and Workplace Relations (2007) Supported Wage System Handbook: July 2007 Edition, Department of Education, Employment and Workplace Relations, Canberra

D Dunoon (1992) Consultancy on the Development of a National Assessment Framework for a Supportive Wages System: Report to the Wages Subcommittee of the Disability Task Force, Department of Industrial Relations, Canberra

Human Rights and Equal Opportunity Commission (2005) Workability 2: Solutions Final Report of the National Inquiry into Employment and Disability, Human Rights and Equal Opportunity Commission, Sydney

KPMG Consulting, Department of Family and Community Services (2001) Supported Wage System Evaluation, Department of Family and Community Services, Canberra

M Pointon, J Leggett, S-K Archer, K Maltman, A Pung and E Leung and Disability Studies Research Centre and People with Disability Australia Incorporated, University of New South Wales (2009) Australian Disability Enterprises: Sector Profile, Australian Fair Pay Commission, Melbourne

C Ronalds (1990) National Employment Initiatives for People with Disabilities Report of the Labour and Disability Workforce Consultancy, a discussion paper, Department of Community Services and Health, Canberra

C Ronalds (1991) Report of the National Consultations with People with a Disability, Department of Health, Housing and Community Services, Canberra

Senate Standing Committee on Community Affairs (1992) Employment of People with Disabilities: Report of the Senate Standing Committee on Community Affairs, Parliament of Australia, Canberra

2. Case Law

Australian Council of Trade Unions & Others (Supported Wage System for People with a Disability) (1994) AIRC PR L5723

Purvis v New South Wales (Department of Education and Training) [2003] HCA 62; (2003) 202 ALR 133)

Wages and Allowances Review (2006) [2006] AIRC, PR002006

Waters v. Public Transport Corporation (1992) 173 CLR 349

3. Legislation

Disability Discrimination Act 1992 (Cth)

Disability Discrimination and Other Human Rights Legislation Amendment Act 2009 (Cth)

Explanatory Memorandum, Disability Discrimination and Other Human Rights Legislation Amendment Bill, 2008 (Cth)

Fair Work Act 2009 (Cth)

Fair Work Amendment (State Referrals and Other Measures) Act 2009 (Cth)

Fair Work (Commonwealth Powers) Act 2009 (Vic)

Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 (Cth)

Workplace Relations (Work Choices) Amendment Act 2005 (Cth)

Workplace Relations Amendment (Transition to Forward with Fairness) Act 2008 (Cth)

Workplace Relations Regulations 2006 (Cth)

4. Other Sources

Australian Bureau of Statistics, (2002) Survey of Disability, Ageing and Carers (SDAC), June 2002, ABS, Canberra

Australian Bureau of Statistics, (2003) Disability, Ageing and Carers, Australia: Summary of Findings, September 2004, ABS, Canberra

Australian Bureau of Statistics, (2004) 2003 Survey of Disability, Ageing and Carers (SDAC), September 2004, CAT No. 4430.0, ABS, Canberra

Department of Families, Housing, Community Services and Indigenous Affairs, (2007) Australian Government Disability Census 2007, Canberra

Australian Government, Submission to the Australian Fair Pay Commission 2006, July 2006

HREOC, Submission to the Australian Fair Pay Commission: For consideration in determining the first national wage decision, July 2006

People with disability and NSW Disability Discrimination Legal Centre, Submission to the Australian Fair Pay Commission Minimum Wage Review 2006: Minimum Wage Determinations, August 2006

Disability Information and Resource Centre Inc., History of Disability in South Australia, http://history.dircsa.org.au/1900-1999/invalid-pension/ accessed at 6 January 2010

Appendix A: Modern Award SWS Model Clause (2010)

A.1 This schedule [clause] defines the conditions which will apply to employees who because of the effects of a disability are eligible for a supported wage under the terms of th[e] award.

A.2 In this schedule:

approved assessor means a person accredited by the management unit established by the Commonwealth under the supported wage system to perform assessments of an individual’s productive capacity within the supported wage system

assessment instrument means the tool provided for under the supported wage system that records the assessment of the productive capacity of the person to be employed under the supported wage system

disability support pension means the Commonwealth pension scheme to provide income security for persons with a disability as provided under the Social Security Act 1991, as amended from time to time, or any successor to that scheme

relevant minimum wage means the minimum wage prescribed in this award for the class of work for which an employee is engaged

supported wage system means the Commonwealth Government system to promote employment for people who cannot work at full award wages because of a disability, as documented in the Supported Wage System Handbook. The Handbook is available from the following website: www.jobaccess.gov.au

SWS wage assessment agreement means the document in the form required by the Department of Education, Employment and Workplace Relations that records the employee’s productive capacity and agreed wage rate

A.3 Eligibility criteria

A.3.1 Employees covered by this schedule will be those who are unable to perform the range of duties to the competence level required within the class of work for which the employee is engaged under this award, because of the effects of a disability on their productive capacity and who meet the impairment criteria for receipt of a disability support pension.

A.3.2 This schedule does not apply to any existing employee who has a claim against the employer which is subject to the provisions of workers compensation legislation or any provision of this award relating to the rehabilitation of employees who are injured in the course of their employment.

A.4 Supported Wage Rates

A.4.1 Employees to whom this schedule applies will be paid the applicable percentage of the relevant minimum wage according to the following schedule:

Assessed capacity (clause A.5) % |

Relevant minimum wage % |

10 |

10 |

20 |

20 |

30 |

30 |

40 |

40 |

50 |

50 |

60 |

60 |

70 |

70 |

80 |

80 |

90 |

90 |

A.4.2 Provided that the minimum amount payable must be not less than $71 per week.

A.4.3 Where an employee’s assessed capacity is 10%, they must receive a high degree of assistance and support.

A.5 Assessment of capacity

A.5.1 For the purpose of establishing the percentage of the relevant minimum wage, the productive capacity of the employee will be assessed in accordance with the Supported Wage System by an approved assessor, having consulted the employer and employee and, if the employee so desires, a union which the employee is eligible to join.

A.5.2 All assessments made under this schedule must be documented in an SWS wage assessment agreement, and retained by the employer as a time and wages record in accordance with the Act.

A.6 Lodgement of SWS wage assessment agreement

A.6.1 All SWS wage assessment agreements under the conditions of this schedule, including the appropriate percentage of the relevant minimum wage to be paid to the employee, must be lodged by the employer with Fair Work Australia.

A.6.2 All SWS wage assessment agreements must be agreed and signed by the employee and employer parties to the assessment. Where a union which has an interest in the award is not a party to the assessment, the assessment will be referred by Fair Work Australia to the union by certified mail and the agreement will take effect unless an objection is notified to Fair Work Australia within 10 working days.

A.7 Review of Assessment

The assessment of the applicable percentage should be subject to annual or more frequent review on the basis of a reasonable request for such a review. The process of review must be in accordance with the procedures for assessing capacity under the supported wage system.

A.8 Other terms and conditions of employment

Where an assessment has been made, the applicable percentage will apply to the relevant minimum wage only. Employees covered by the provisions of this schedule will be entitled to the same terms and conditions of employment as other workers covered by this award on a pro rata basis.

A.9 Workplace adjustment

An employer wishing to employ a person under the provisions of this schedule must take reasonable steps to make changes in the workplace to enhance the employee’s capacity to do the job. Changes may involve re-design of job duties, working time arrangements and work organisation in consultation with other workers in the area.

A.10 Trial period

A.10.1 In order for an adequate assessment of the employee’s capacity to be made, an employer may employ a person under the provisions of this schedule for a trial period not exceeding 12 weeks, except that in some cases additional work adjustment time (not exceeding four weeks) may be needed.

A.10.2 During that trial period the assessment of capacity will be undertaken and the percentage of the relevant minimum wage for a continuing employment relationship will be determined.

A.10.3 The minimum amount payable to the employee during the trial period must be no less than $71 per week.

A.10.4 Work trials should include induction or training as appropriate to the job being trialled.

A.10.5 Where the employer and employee wish to establish a continuing employment relationship following the completion of the trial period, a further contract of employment will be entered into based on the outcome of assessment under clause A.5.

Appendix B: SWS Model Clause (1994)

1 Workers eligible for a supported wage

(a) This clause defines the conditions which will apply to employees who because of the effects of a disability are eligible for a supported wage under the terms of this agreement/award. In the context of this clause, the following definitions will apply:

(i) “Supported Wage System” means the Commonwealth Government System to promote employment for people who cannot work at full award wages because of a disability, as documented in “[Supported Wage System: Guidelines and Assessment Process]”.

(ii) “Accredited Assessor” means a person accredited by the management unit established by the Commonwealth under the Supported Wage System to perform assessments of an individual’s productive capacity within the Supported Wage System.

(iii) “Disability Support Pension” means the Commonwealth pension scheme to provide income security for persons with a disability as provided under the Social Security Act 1991, as amended from time to time, or any successor to that scheme.

(iv) “Assessment instrument” means the form provided for under the Supported Wage System that records the assessment of the productive capacity of the person to be employed under the Supported Wage System.

Eligibility criteria

(b) Employees covered by this clause will be those who are unable to perform the range of duties to the competence level required within the class of work for which the employee is engaged under this agreement/award, because of the effects of a disability on their productive capacity and who meet the impairment criteria for receipt of a Disability Support Pension.

(The clause does not apply to any existing employee who has a claim against the employer which is subject to the provisions of workers’ compensation legislation or any provision of this agreement/award relating to the rehabilitation of employees who are injured in the course of their current employment).

The award does not apply to employers in respect of their facility, programme, undertaking service or the like which receives funding under the Disability Services Act 1986 and fulfills the dual role of service provider and sheltered employer to people with disabilities who are in receipt of or are eligible for a disability support pension, except with respect to an organisation which has received recognition under s.10 or under s.12A of the Act, or if a part only has received recognition, that part.

Supported wage rates

(c) Employees to whom this clause applies shall be paid the applicable percentage of the minimum rate of pay prescribed by this award/agreement for the class of work which the person is performing according the following schedule:

Assessed capacity (sub-clause (d)) |

% of prescribed award rate |

10%* |

10% |

20% |

20% |

30% |

30% |

40% |

40% |

50% |

50% |

60% |

60% |

70% |

70% |

80% |

80% |

90% |

90% |

(Provided that the minimum amount payable shall be not less than $45 per week).

*Where a person’s assessed capacity is 10%, they shall receive a high degree of assistance and support.

Assessment of capacity

(d) For the purpose of establishing the percentage of the award rate to be paid to an employee under this award/agreement, the productive capacity of the employee will be assessed in accordance with the Supported Wage System and documented in an assessment instrument by either:

(i) the employer and a union party to the award/agreement, in consultation with the employee or, if desired by any of these;

(ii) the employer and an accredited Assessor from a panel agreed by the parties to the award and the employee.

Lodgment of assessment instrument

(e) (i) All assessment instruments under the conditions of this clause, including the appropriate percentage of the award wage to be paid to the employee, shall be lodged by the employer with the Registrar of the Industrial Relations Commission

(ii) All assessment instruments shall be agreed and signed by the parties to the assessment, provided that where a union which is party to the award/agreement, is not a party to the assessment, it shall be referred by the Registrar to the union by certified mail and shall take effect unless an objection is notified to the Registrar within 10 working days.

Review of assessment

(f) The assessment of the applicable percentage should be subject to annual review or earlier on the basis of a reasonable request for such a review. The process of review shall be in accordance with the procedures for assessing capacity under the Supported Wage System.

Other terms and conditions of employment

(g) Where an assessment has been made, the applicable percentage shall apply to the wage rate only. Employees covered by the provisions of the clause will be entitled to the same terms and conditions of employment as all other workers covered by this award/agreement paid on a pro rata basis.

Workplace adjustment

(h) An employer wishing to employ a person under the provisions of this clause shall take reasonable steps to make changes in the workplace to enhance the employee’s capacity to do the job. Changes may involve re-design of job duties, working time arrangements and work organisation in consultation with other workers in the area.

Trial period

(i) In order for an adequate assessment of the employee’s capacity to be made, an employer may employ a person under the provisions of this clause for a trial period not exceeding 12 weeks, except that in some cases additional work adjustment time (not exceeding 4 weeks) may be needed.

(ii) During that trial period the assessment of capacity shall be undertaken and the proposed wage rate for a continuing employment relationship shall be determined.

(iii) The minimum amount payable to the employee during the trial period shall be no less than $45 per week.

[or in paid rates awards]

(iii) The amount payable to the employee during the trial period shall be $45 per week or such greater amount as is agreed from time to time between the parties (taking into account the Department of Social Security income test free area for earnings) and inserted into this Award.

(iv) Work trials should include induction or training as appropriate to the job being trialled.

(v) Where the employer and employee wish to establish a continuing employment relationship following the completion of the trial period, a further contract of employment shall be entered into based on the outcome of assessment under subclause (c) hereof.

Appendix C: AFPC Special Federal Minimum Wage No.1

This document has been published for illustrative purposes only.

It is not a legal instrument, nor does it purport to contain legal interpretations of the relevant instruments.

The text of the full wage-setting decisions giving effect to the content of Special Supported Wage System (Employees with a Disability) Pay Scale can be accessed at:

http://www.fwa.gov.au/sites/afpc2006wagereview/documents/AFPCOctober2006WSD.pdf

New special Federal Minimum Wage No.1 - Employees with a disability who are able to earn full adult, junior or trainee wages as the effects of their disability do not impact on their productive capacity

1. Interpretation

In this special FMW:

Commission means the Australian Fair Pay Commission;

Pay Scale means an Australian Pay and Classification Scale;

employee with a disability has the same meaning as in section 178 of the Act;

standard FMW means the standard FMW under section 175 of the Act;

training arrangement has the same meaning as in section 178 of the Act.

Special Federal Minimum Wage

2. A special FMW of an amount equal to the standard FMW applies to an employee with a disability who:

a) is not a junior employee; and

b) is not an employee to whom a training arrangement applies; and

whose employment is not covered by:

c) a Pay Scale; or

d) another special Federal Minimum Wage decision.

3. This special FMW does not operate as a minimum standard for any Pay Scale.

Appendix D: AFPC Special Federal Minimum Wage No.2

This document has been published for illustrative purposes only.

It is not a legal instrument, nor does it purport to contain legal interpretations of the relevant instruments.

The text of the full wage-setting decisions giving effect to the content of Special Supported Wage System (Employees with a Disability) Pay Scale can be accessed at:

http://www.fwa.gov.au/sites/afpc2006wagereview/documents/AFPCOctober2006WSD.pdf

New special Federal Minimum Wage No.2 - Employees with a disability who are unable to perform the range of duties to the competence level required because of the effects of a disability on their productive capacity – and are not currently covered by a Pay Scale

1. Interpretation

In this special FMW:

Accredited Assessor means a person accredited by the management unit established by the Commonwealth under the Supported Wage System to perform assessments of an individual’s productive capacity within the Supported Wage System;

Assessment instrument means the completed form provided for under the Supported Wage System that records the assessment of the productive capacity of the person to be employed under the Supported Wage System;

Commission means the Australian Fair Pay Commission;

Employee with a disability has the same meaning as in section 178 of the Act;

Special FMW means special Federal Minimum Wage;

Standard FMW means standard Federal Minimum Wage under section 175 of the Act;

Pay Scale means an Australian Pay and Classification Scale;

Supported Wage System means the Commonwealth Government System to promote employment for people who cannot work at full wages because of a disability, as documented in “Supported Wage System: Guidelines and Assessment Process”.

Training arrangement has the same meaning as in section 178 of the Act.

Special Federal Minimum Wage

2. Coverage of this special FMW

2.1 This special FMW applies to an employee with a disability:

a) who is unable to perform the range of duties to the competence level required of an employee within the class of work for which the employee is engaged because of the effects of a disability on their productive capacity;

b) who meets the impairment criteria for receipt of a Disability Support Pension; and

c) whose employment is not subject to a Pay Scale or a special Pay Scale.

2.2 This special FMW does not apply to an existing employee who has a claim against the employer which is subject to the provisions of workers’ compensation legislation.

2.3 This special FMW does not apply to employers in respect of their facility, program, undertaking, service of the like which receives funding under the Disability Services Act 1986 and fulfils the dual role of business service provider and sheltered employer to people with disabilities who are receiving or are eligible for a disability support pension.

2.4 This special FMW does not apply to an employee with a disability who is a junior employee or an employee to whom a training arrangement applies.

3. Supported wage rates

3.1 The minimum hourly rate payable to an employee covered by this special FMW is the greater of the hourly rates calculated in accordance with the method specified in clause 4 and the method specified in clause 5.

4. Assessed capacity method

4.1 The minimum hourly rate payable to an employee in respect of whom an assessment has been made is the percentage of the standard FMW ($14.31 per hour) that applies to the employee in accordance with the following table:

Assessed productive capacity |

% of standard FMW |

10%* |

10% |

20% |

20% |

30% |

30% |

40% |

40% |

50% |

50% |

60% |

60% |

70% |

70% |

80% |

80% |

90% |

90% |

4.2 The productive capacity of the employee is to be assessed in accordance with the Supported Wage System and documented in an assessment instrument by either: